Form 5472 is an IRS informational return for foreign-owned U.S. corporations or those engaged in a U.S. trade/business, reporting transactions with related parties annually under sections 6038A and 6038C.

1.1 Overview of IRS Form 5472

IRS Form 5472 is an annual informational return required for foreign-owned U.S. corporations or those engaged in a U.S. trade or business. It reports transactions with related parties, both foreign and domestic, ensuring compliance with sections 6038A and 6038C. The form provides detailed disclosures about these transactions, and recent updates have enhanced reporting requirements to align with current IRS regulations.

1.2 Purpose of the Form

Form 5472 is designed to report transactions between a foreign-owned U.S. corporation or a foreign corporation engaged in a U.S. trade or business and its related parties. The form ensures compliance with IRS regulations under sections 6038A and 6038C, promoting transparency in international transactions and adherence to U.S. tax laws, with recent updates enhancing reporting accuracy and regulatory alignment.

Key Definitions and Terminology

Key terms include Reporting Corporation, referring to foreign-owned U.S. entities or those engaged in U.S. trade/business, and Related Party Transactions, involving dealings with affiliated entities or individuals.

2.1 Reporting Corporation

A Reporting Corporation is a foreign-owned U.S. corporation or a foreign corporation engaged in a U.S. trade or business. It must file Form 5472 annually to report transactions with related parties. This includes entities claiming treaty exemptions, ensuring compliance with IRS requirements for transparency in international dealings. Accurate reporting is crucial for maintaining regulatory adherence and avoiding penalties.

2.2 Related Party Transactions

Related Party Transactions involve exchanges between a reporting corporation and its foreign or domestic related parties, such as parent companies, subsidiaries, or other entities with control or significant influence. These include rent, royalties, loans, and service fees. Accurate reporting of such transactions on Form 5472 is essential to ensure compliance with IRS regulations and avoid penalties. The definition of a related party is critical for proper disclosure.

Eligibility and Filing Requirements

Eligibility for filing Form 5472 is based on having reportable transactions with related parties. The form must be filed annually, with deadlines tied to the tax year, generally April 15, but extensions may apply. Exceptions exist for certain transactions or entities under IRS rules.

3.1 Who Must File Form 5472

Foreign-owned U.S. corporations and foreign corporations engaged in a U.S. trade or business must file Form 5472. This includes entities with reportable transactions exceeding $5,000 with related parties. Specific rules apply to disregarded entities and branches. The form must be filed annually by the tax year’s end, with submissions directed to the IRS Philadelphia Service Center. Proper compliance ensures adherence to IRS regulations.

3.2 Exceptions and Exemptions

Certain corporations may be exempt from filing Form 5472 under specific conditions. For example, if a foreign-owned U.S. corporation has no reportable transactions, it may not need to file. Additionally, foreign corporations not engaged in a U.S. trade or business are exempt. Specific transactions or entities, as outlined in IRS regulations, may also qualify for exemptions. Always consult IRS instructions for the most accurate guidance.

Instructions for Completing Form 5472

Form 5472 requires detailed reporting of transactions with related parties, including identifying parties and summarizing transactions. Ensure compliance with IRS guidelines for accurate submission.

4.1 General Filing Instructions

Form 5472 must be filed annually with the IRS by foreign-owned U.S. corporations or those engaged in a U.S. trade/business. Submit the form by the due date of the corporation’s tax return, typically March 15 for calendar-year entities. A duplicate must be filed with the IRS Center in Philadelphia, PA. Ensure accurate reporting of related party transactions and compliance with IRS guidelines to avoid penalties.

4.2 Specific Rules for Related Parties

Form 5472 requires detailed reporting of transactions with related parties, defined as individuals or entities with direct or indirect control. This includes parent companies, subsidiaries, or entities under common control. Transactions must be reported regardless of the amount, ensuring transparency and compliance with IRS regulations to prevent penalties.

Recent Updates and Changes

Form 5472 has undergone recent updates, with the IRS releasing revised drafts and instructions to enhance reporting clarity and accuracy for international transactions.

5.1 IRS Updates to Form 5472

The IRS has released updated drafts of Form 5472 and its instructions, enhancing clarity and accuracy in reporting international transactions. These changes aim to improve compliance with sections 6038A and 6038C, focusing on transparency in foreign-owned U.S. corporations’ transactions with related parties. The updates reflect ongoing efforts to align the form with evolving tax regulations and reporting standards, ensuring proper documentation of all required information.

5.2 Impact of Recent Regulatory Changes

Recent regulatory changes have enhanced transparency and compliance requirements for corporations filing Form 5472. These updates aim to improve reporting accuracy for international transactions, ensuring proper documentation of related-party dealings. The changes may increase administrative burdens but are crucial for maintaining compliance with evolving IRS standards, ultimately reducing the risk of penalties and ensuring adherence to global tax reporting norms.

Compliance and Penalty Information

Failure to comply with Form 5472 requirements may result in significant penalties, emphasizing the importance of accurate reporting and adherence to IRS guidelines.

6.1 Consequences of Non-Compliance

Non-compliance with Form 5472 requirements can lead to significant penalties, including fines and potential legal action. The IRS may impose penalties for late or inaccurate filings, emphasizing the necessity of strict adherence to reporting obligations. Failure to file or provide complete information can result in substantial financial repercussions and complications with tax compliance. Accuracy and timely submission are crucial to avoid such consequences.

6.2 Best Practices for Avoiding Penalties

To avoid penalties, ensure timely and accurate filing of Form 5472. Maintain detailed records of all related-party transactions and consult tax professionals for compliance. Understand definitions of related parties and reportable transactions. Double-check all information before submission and stay updated on IRS guidelines to ensure adherence to filing requirements and avoid costly errors.

Related Forms and Documentation

Form 5472 often requires additional documentation, such as transfer pricing studies and records of related-party transactions, to ensure compliance with IRS regulations and reporting standards accurately.

7.1 Additional Forms Required for Filing

Filing Form 5472 may require additional forms, such as Schedule M-3 for reconciling financial statements and Form 926 for certain property transfers. Documentation, including transfer pricing studies and records of related-party transactions, must also be maintained to comply with IRS regulations and ensure accurate reporting of international transactions and activities.

7.2 Supporting Documentation Needs

Maintaining detailed records of related-party transactions is crucial for compliance with IRS regulations. This includes transfer pricing studies, financial statements, and any agreements or contracts related to the transactions. These documents ensure accuracy in reporting and are essential for audits and demonstrating compliance with Form 5472 requirements.

Industry-Specific Considerations

Form 5472 applies to foreign-owned U.S. corporations and those engaged in U.S. trade or business, requiring detailed reporting of related-party transactions and compliance with specific IRS guidelines.

8.1 Special Rules for Foreign-Owned U.S. Corporations

Foreign-owned U.S. corporations must file Form 5472 to report transactions with related parties, adhering to specific IRS rules. These corporations must disclose detailed financial interactions, ensuring compliance with U.S. tax regulations. Annual filing is mandatory, with penalties for non-compliance. The form focuses on transparency in international transactions, aligning with U.S. tax laws and promoting fair reporting practices for foreign entities operating within the U.S. market.

8.2 Unique Requirements for U.S. Trade or Business Activities

Corporations engaged in a U.S. trade or business must report specific transactions with related parties on Form 5472. This includes detailing monetary interactions and ensuring compliance with U.S. tax laws. The form requires accurate disclosure of these activities to maintain transparency and avoid penalties, ensuring adherence to IRS regulations for entities operating within the U.S. market.

Filing Process and Deadlines

Form 5472 must be filed annually by the due date of the corporation’s tax return, with extensions available under specific conditions. Timely filing ensures compliance.

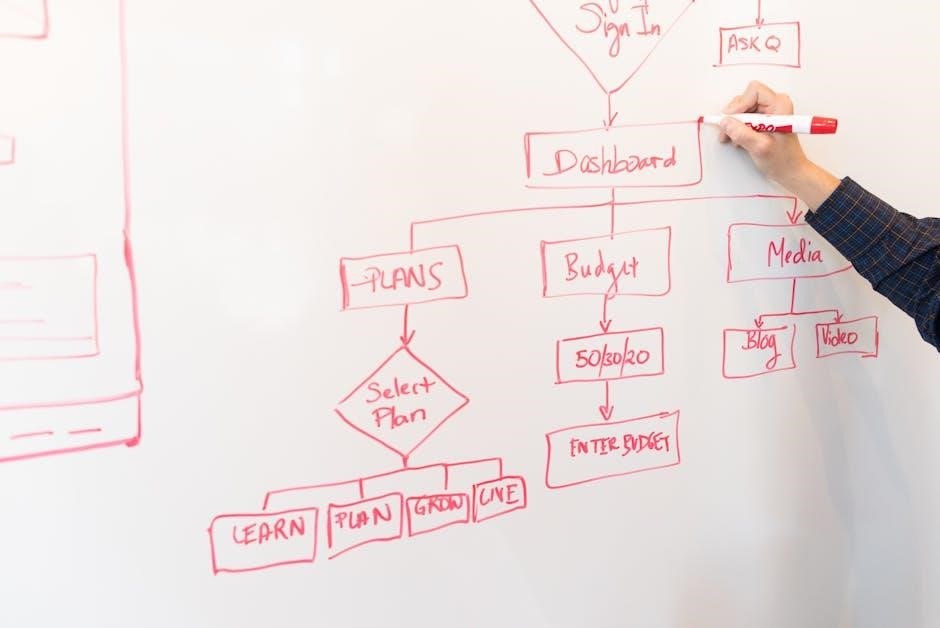

9.1 Step-by-Step Filing Guide

- Obtain Form 5472 from the IRS website or through authorized tax software.

- Fill in the corporation’s identifying information and details of related parties.

- Report all relevant transactions, including dates, amounts, and descriptions.

- Ensure compliance with specific rules for related parties and transactions.

- Submit the form by the designated deadline to avoid penalties.

- Maintain a copy of the filed form for your records.

9.2 Important Dates and Deadlines

Form 5472 must be filed by April 15th for the preceding tax year. Extensions are available for up to six months by filing Form 7004. A duplicate form must be submitted to the IRS Center in Philadelphia, PA. Deadlines are strictly enforced, and late filings may result in penalties. Always verify the IRS website for the most current deadlines and requirements.

Future Outlook and Implications

Expect IRS updates to Form 5472, reflecting FY 2025 budget priorities for efficient operations and strategic alignment. Future changes may introduce enhanced reporting requirements and digital solutions to ensure compliance with national guidance.

10.1 Expected Changes in IRS Regulations

The IRS plans to update Form 5472 to enhance reporting transparency and compliance, aligning with FY 2025 budget priorities. Expected changes include new rules for digital submissions, expanded transaction disclosures, and stricter guidelines for foreign-owned entities. These updates aim to improve data accuracy and ensure alignment with evolving federal tax policies and international reporting standards.

10.2 Impact on Corporate Compliance Strategies

Expected IRS changes to Form 5472 will require corporations to adapt compliance strategies, enhancing transparency and accuracy in reporting. Companies may need to invest in updated systems and training to manage expanded disclosures and digital submissions. Proactive engagement with tax professionals and internal audits will be crucial to navigate evolving regulations and avoid penalties, ensuring alignment with federal tax policies and international standards.